22+ penp calculation hmrc

The legislation doesnt define a pay period but its a crucial part of the PENP. The PENP formula is.

Taxing Termination Payments Six Months On Bm Insights Blake Morgan

Web Guidance HMRC tools and calculators Find and use tools and calculators that will help you work out your tax.

. Web Under HMRCs standard PENP formula. In the PENP formula P is the number of calendar days in the employees last pay period ending before the. Web Since 16 October 2019 published HMRC guidance has allowed employers to use the average number of days in a month 3042 ie.

However the conditions for the. While in many cases PENP will be nil in these circumstances that will not always be the case as the following example illustrates. Web The conditions for the simplified calculation by months at s402D 6 are not met because the post-employment notice period is not a whole number of months.

Web an alternative calculation for PENP for use where the known inconsistency arises and the alternative calculation is advantageous to the employee. However following these changes to the PENP calculation the employer must. Web The PENP formula reduces the amount of post-employment notice pay by the amount of any PILON received in connection with the termination of a persons employment which is chargeable to income tax.

Web The amount of post-employment notice pay is calculated using the PENP formula. BP D P T BP is the employees basic pay in respect of the. An employer is required to calculate the amount of PENP using this formula whether or not the employee or.

Web Broadly PENP calculated in accordance with a statutory formula represents the basic pay an employee would have received had they worked their notice period in full. If you have any questions about this change or comments on the. Web Post-employment notice pay is calculated using the PENP formula see EIM13880.

And T is 0. Web HMRC has made changes to the calculation for Post-Employment Notice Pay PENP specifying the calculation to be made where an employees pay period is defined in months but their contractual notice period or post-employment notice period is not a whole. Dealing with leavers Maintained Golden parachutes Maintained Tax treatment of damages Maintained Taxation of employees.

This element of the payment should be subject to tax and NICs both. This will continue to apply until 6 April 2021. Web In July HMRC published draft legislation affecting Post-Employment Notice Pay PENP.

Example Employee D earns 10000 a month 30 day pay period and has a 12 week notice period. BP is is 3000. BP x DP T Where.

There is an alternative PENP calculation if an employees pay period is defined in terms of months but where their contractual notice. BP basic pay in the pay period which ends prior to the date on which notice is given if any or if no notice is given the termination date relevant pay period D the. What is a pay period.

These changes are expected to take effect from 6 April 2021 pending Parliamentary approval. 365 12 for P the number of days in an employees last pay period to end before the trigger date in the PENP formula. Web There have been no taxable termination payments already made T.

Web PENP Calculation Recap. P is 28 the number of days in the February pay period before notice of termination is given. Web PENP is calculated by applying the prescribed formula see box to the total amount of the payment or benefits paid in connection with the termination of an employment.

Web From 6 April 2014 the annual allowance for tax relief on pension savings pension input amounts in a registered pension scheme was reduced to 40000. As employer makes a termination award of 10000. Web Post-employment notice pay is calculated using the PENP formula set out in section 402D ITEPA 2003.

Web HMRC releases policy paper on changes to the treatment of termination payments. The changes give an alternative PENP calculation where an employees pay. Web The PENP calculation is set out below although you should also see section 13 below for a revised calculation which must be used in cases where the employee is paid monthly the notice period is expressed in months and the unworked notice period is a whole number.

BP 3000 x D 2 T nil 6000 the PENP 6000 of the 10000 termination award is treated as. Web PENP is generally calculated using the following formula. This includes contributions made by anyone else into your pension such as your employer.

However the PENP formula can give rise to unintended results where. Web Calculating pensions loss on termination of employment Maintained Dismissing a senior executive Maintained Employee share schemes. Web HMRC agreed to answer some specific questions which I discuss here to help you ensure that the tax treatment of termination payments is correct.

As such from April 2021 HMRC is seeking to align the treatment of the PENP with the value calculated being subject to tax and National Insurance in the UK as if the employee had worked in the UK during their notice period regardless. HM Revenue Customs Published 6 April 2010 Last updated 29 July 2022 See.

Common Pitfalls Employers Face When Calculating Post Employment Notice Pay

Tax Page 2 Employment Notes

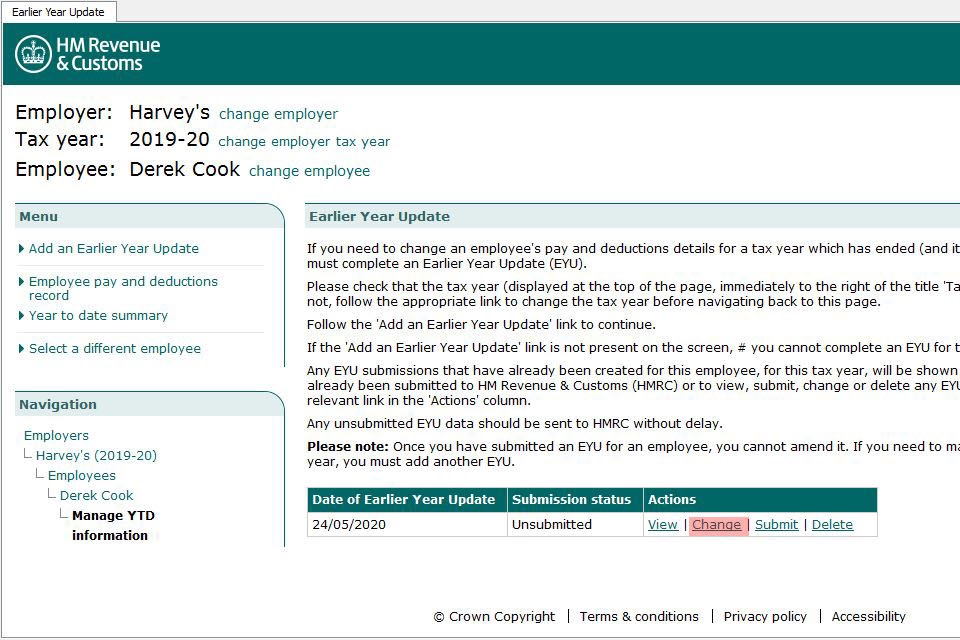

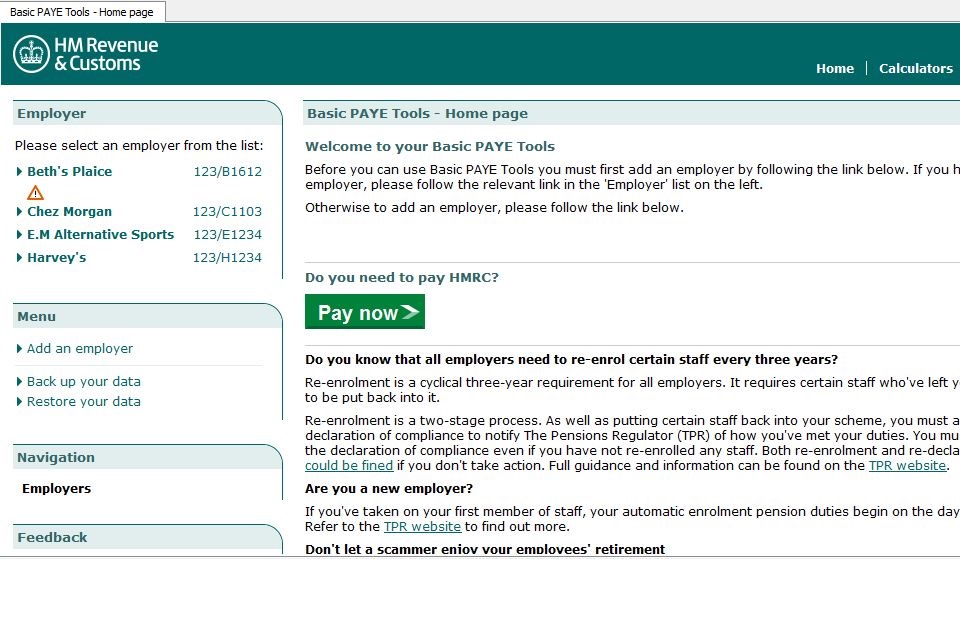

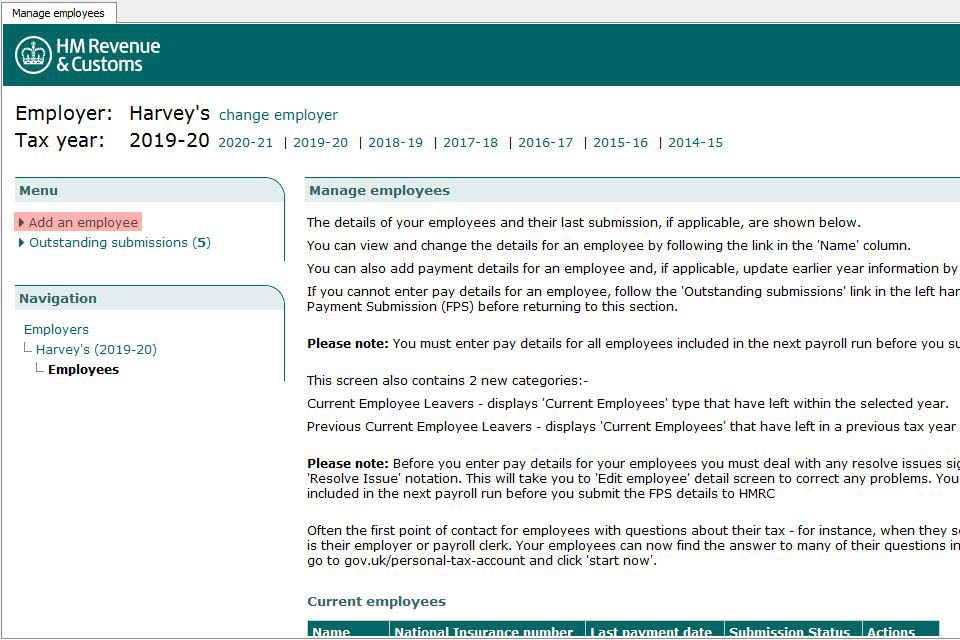

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Termination Payments And Post Employment Notice Pay Penp Updated Hmrc Guidance Lexology

Hmrc Deadline Extension Creates State Pension Headache Financial Times

Hmrc Confirm Changes To Calculating Post Employment Kpmg United Kingdom

Changes To Calculation Of Post Employment Notice Pay Morton Fraser Lawyers Edinburgh And Glasgow

Tax Services For Business Birketts

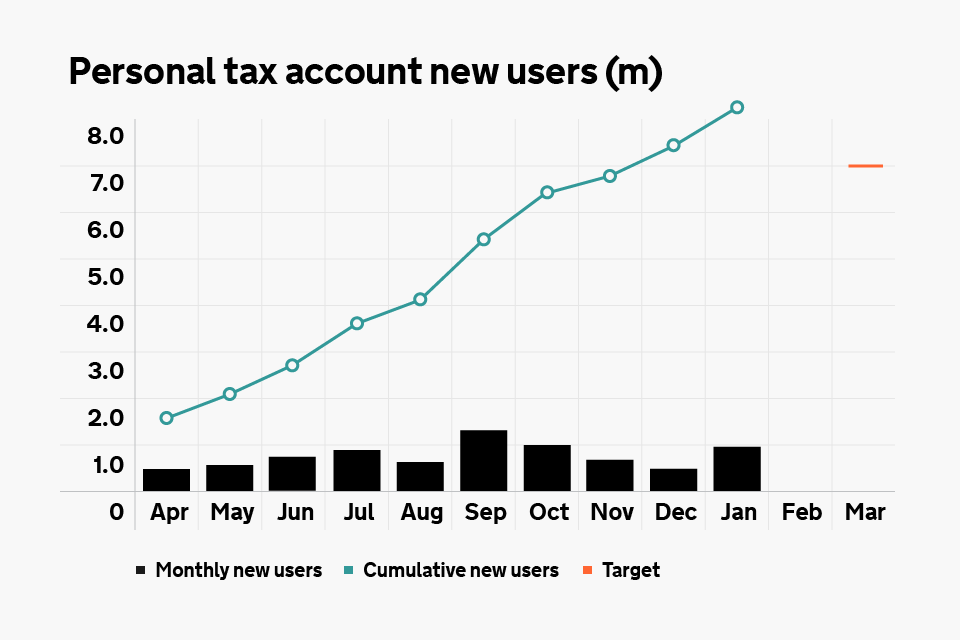

Hmrc Monthly Performance Update January 2017 Gov Uk

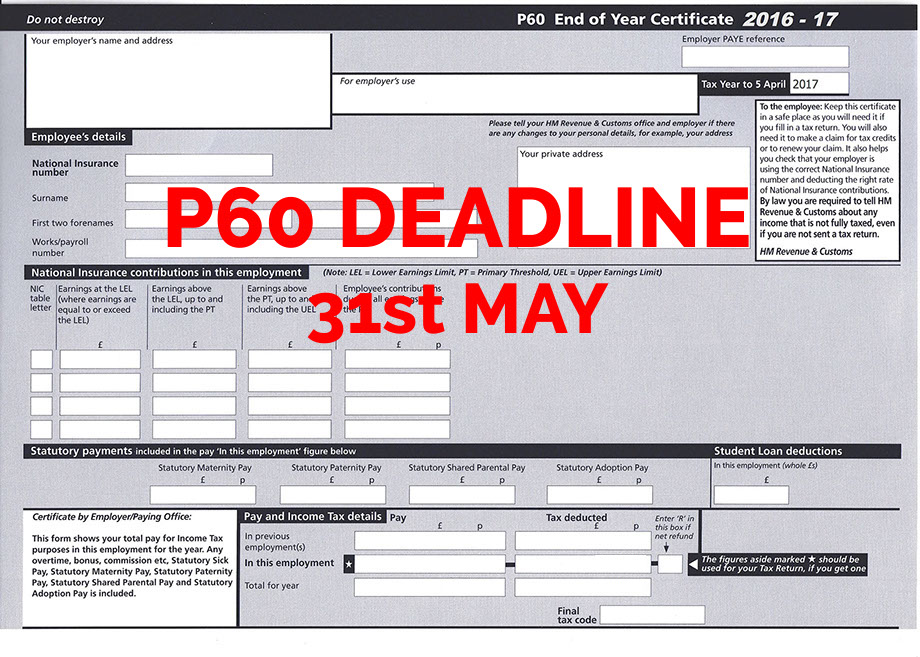

Uk Hmrc P60 Deadline May 2017

Payment In Lieu Of Notice Pilon Devonshires

Send An Earlier Year Update Using Basic Paye Tools Gov Uk

Tax Services For Business Birketts

National Living Wage Earners Fall Short Of Average Family Spending Office For National Statistics

Send An Earlier Year Update Using Basic Paye Tools With Other Software Gov Uk

Hmrc Spends 84m On Debt Collection Agencies In Three Years Your Money

Termination Payments Two Changes To Be Aware Of